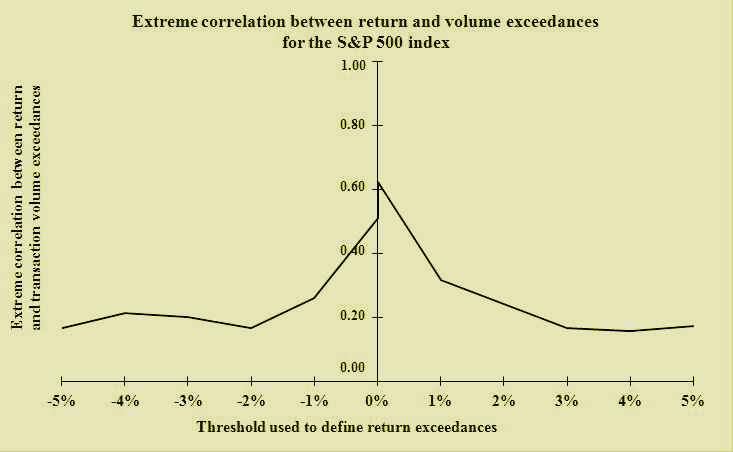

Using daily data of the S&P 500 index from 1950 to 2015, we investigate the relation between return and transaction volume in the statistical distribution tails associated with booms and crashes in the US stock market. We use extreme value theory (peaks-over-threshold method) to study the extreme dependence between the two variables. We show that the extreme correlation between return and volume decreases as we consider larger events in both the left and right distribution tails (see the figure below).

From an economic viewpoint, this paper contributes to a better understanding of the activity of market participants during extreme events. Our empirical result is consistent with the economic explanation by Gennotte and Leland (1990) of extreme price movements based on misinterpretation of trades by market participants.

Minimal returns and the breakdown of the price-volume relation

Minimal returns and the breakdown of the price-volume relation

The asymptotic distribution of extreme stock market returns

The asymptotic distribution of extreme stock market returns

Portfolio insurance and market crashes

Portfolio insurance and market crashes

Return to the publication list

Return to the publication list